Protecting Your Legacy: Key Considerations When Selling to Strategic Buyers

You’ve built more than just a business—your legacy extends beyond financial value to inspire employees and management long after your exit, providing a foundation for the company’s culture, values, and future direction.When strategic buyers come knocking with an unexpected offer, the decisions you make will determine not just your financial outcome, but the future of everything you’ve built. Understanding your options and the current landscape of strategic acquisitions has never been more critical.

The Shifting Strategic Buyer Landscape

Buyers are increasingly focusing on smaller, add-on acquisitions rather than new platform investments. According to recent market data, over 40% of lower-middle market deals in 2023 involved US public companies as buyers, with another 24% coming from non-PE-backed private companies. This shift has created a unique environment for smaller deals in the $10-25 million enterprise value range.

What’s driving this trend? With economic uncertainty lingering, private equity and strategic buyers see lower-risk opportunities in add-on acquisitions that complement existing operations rather than venturing into entirely new platforms.

Beyond the Balance Sheet: Employee and Customer Transitions

A successful transaction with the right buyer hinges on more than just financials. The timing and approach to involving your management team can significantly impact both deal outcomes and post-close success. Management team involvement can affect valuation, deal structure, and even the buyer’s perception of business continuity risks.

Consider this critical question: At what stage should key employees be informed of a potential transaction?

Early involvement risks unsettling your organization, while late involvement may leave insufficient time for thoughtful transition planning. Strategic buyers increasingly value seeing a clear continuity plan for key customer relationships and talent retention beyond financial incentives.

Cultural integration planning has emerged as a make-or-break factor in strategic acquisitions. With approximately 60% of recent lower-middle market deals involving strategic buyers, cultural alignment has become a focal point during due diligence. Successful sellers proactively address this by developing cultural integration roadmaps before they’re requested.

Deal Structures Evolving for 2025

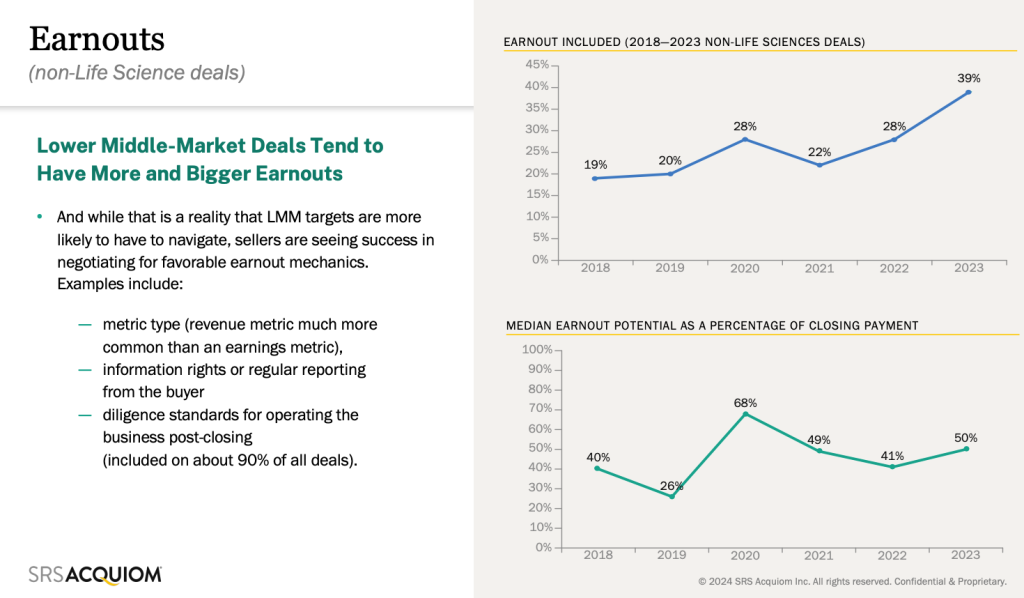

The structure of strategic acquisitions continues to evolve. While all-cash deals are becoming more common again (nearly three-quarters of lower-middle market deals closed in 2024), strategic buyers are increasingly using sophisticated earnout mechanisms. Recent data shows that lower- middle market deals are significantly more likely to include earnouts than larger transactions, with the median earnout potential reaching 39% of closing payment in 2023.

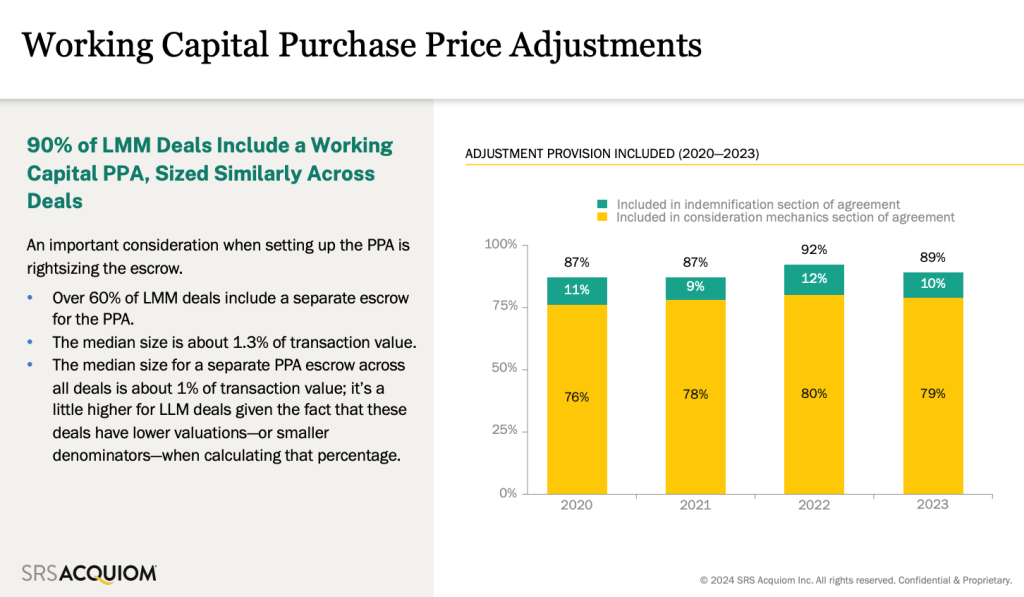

Working capital adjustments appear in over 90% of lower-middle market deals, with approximately 60% including separate escrow provisions averaging 1.3% of transaction value. Furthermore, every lower-middle-market deal that closed in 2023 included some form of post-closing security via escrow or holdback provisions.

Preserving Your Legacy Through Post-Closing Involvement

Your involvement doesn’t need to end at closing. Strategic acquirers increasingly value transition periods where founding owners remain engaged through employment agreements, consulting arrangements, or board positions. These structures can help preserve your legacy while ensuring a smooth handoff of customer and employee relationships.

The key is designing these arrangements with clear expectations and defined timelines. Rather than open-ended commitments, successful transitions typically include specific milestones and knowledge transfer objectives. This approach protects both your legacy and your ability to eventually make a clean break.

Planning Your Next Move

As you contemplate a potential sale, consider these essential questions:

- How will your management team respond to acquisition discussions, and when should they be involved?

- What mechanisms can protect your employees and customers through the transition?

- Which deal structure elements are negotiable versus non-negotiable for preserving your legacy?

- What post-closing role would best serve both your personal goals and the business’s future?

Partnering with Strategic Exit Advisors

Our team of M&A experts specializes in helping entrepreneurs like you navigate both the financial complexities and emotional challenges of strategic exits. We take the time to understand your unique transition goals and tailor our approach to achieve clearly defined outcomes that align with your vision.

Whether you’re exploring an unexpected offer or planning a future exit, our advisory team stands ready to optimize your strategy and secure your legacy.

When entrepreneurs work with SEA, they partner with experienced M&A experts who understand both the financial and emotional aspects of selling a business.

Ready to explore how your company’s proven performance can command a premium in today’s market?

Contact us at (215) 489-8881 or schedule a conversation here.

Ready to learn more?

Whether you’ve just received an unexpected offer for your business or you’re preparing for future possibilities, our “I Received an Offer, What Do I Do?” series provides invaluable insights to help you navigate transitioning ownership of your business with confidence.

Explore the series:

- I Received an Offer, What Do I Do?

- The Offer: When to Seek a Trusted Advisor

- Demystifying Deal Points: Understanding the Essentials

- Strategic Information Release: Timing is Everything

- Sub-Negotiations Unveiled: Beyond the Bottom Line

- The Art of Concluding: Expert Insights from SEA

- Common Pitfalls: Negotiation NoNo’s You Should Avoid

- Navigating the Psychological Terrain: Ego and Emotional Intelligence